Iras tax calculator

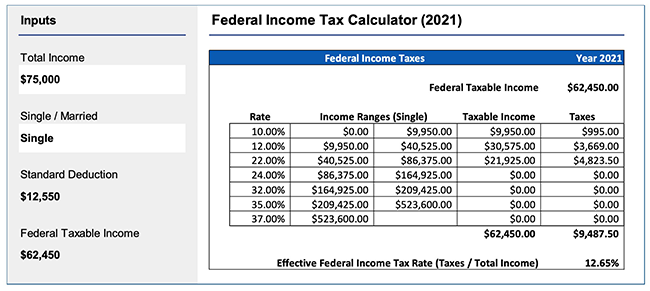

Our income tax calculator calculates your federal state and local taxes based on several key inputs. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

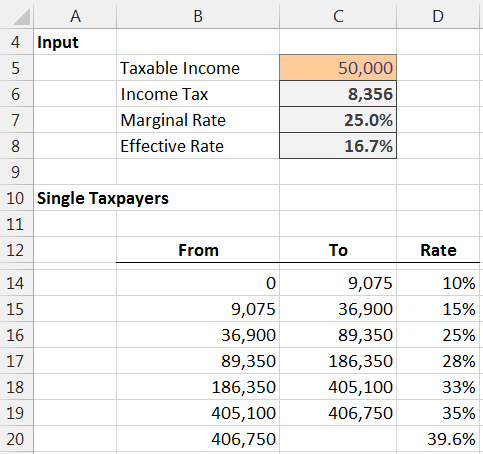

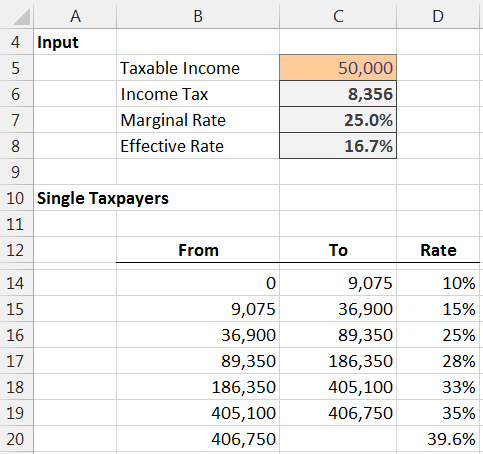

How To Calculate Income Tax In Excel

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free.

. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. PTR Calculator XLSM 52KB Documents Tax calculator_Residents_YA22 XLS 131KB Documents Tax Calculator for Non-Resident Individuals XLS 95KB Pages What is taxable. Account balance as of December 31 2021.

New York Income Tax Calculator 2021. See your tax refund estimate. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

You have nonresident alien status. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Your average tax rate is 1198 and your marginal tax.

How is my RMD calculated. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Unfortunately there are limits to how much you can save in an IRA.

Not everyone is eligible to contribute this. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. For instance if you expect your income level to be lower in a particular year but increase again in later years.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Converting to a Roth IRA may ultimately help you save money on income taxes. If youve already paid more than what you will owe in taxes youll likely receive a refund.

We provide guidance at critical junctures in your personal and professional life. Visit The Official Edward Jones Site. New Look At Your Financial Strategy.

Your household income location filing status and number of personal. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Your household income location filing status and number of personal. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients. Well calculate the difference on what you owe and what youve paid. Estimate your tax withholding with the new Form W-4P.

Ad Unlock Your Access To Essential Financial Planning Tools Get Appointed Today. Ad Tax Strategies that move you closer to your financial goals and objectives. Your life expectancy factor is taken from the IRS.

For comparison purposes Roth IRA and regular. Visit The Official Edward Jones Site. While long-term savings in a Roth IRA may produce better after-tax returns a.

If you make 70000 a year living in the region of New York USA you will be taxed 12312. New Look At Your Financial Strategy. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

Currently you can save 6000 a yearor 7000 if youre 50 or older.

Excel Formula Income Tax Bracket Calculation Exceljet

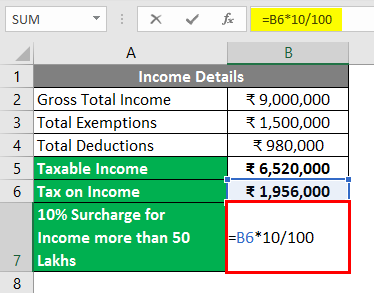

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

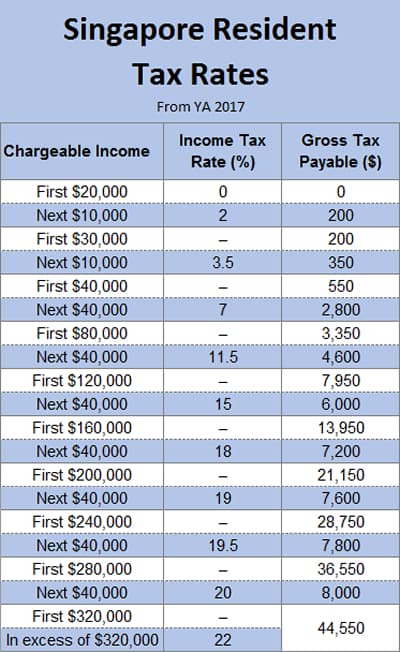

Singapore Tax Calculator On Google Spreadsheet Just2me

Traditional Vs Roth Ira Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Income Tax Formula Excel University

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Inkwiry Federal Income Tax Brackets

How To Calculate Income Tax In Excel

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

Income Tax Formula Excel University

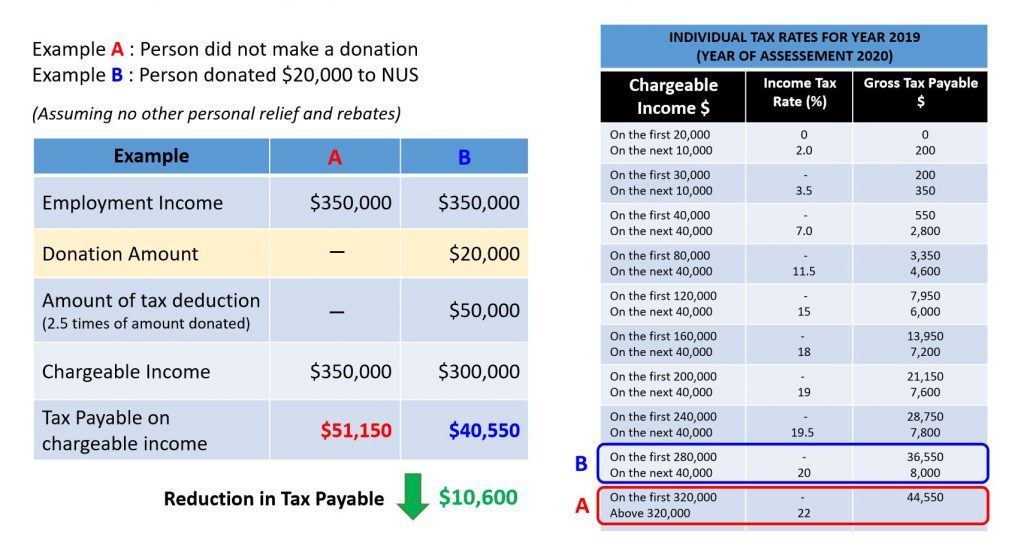

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine